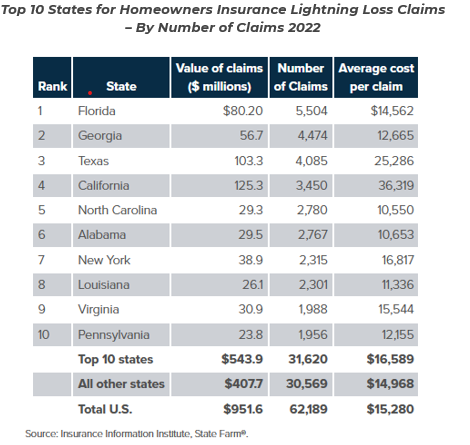

Lightning strikes about one in every 200 homes in the U.S. each year. Last year, there were more than 62,000 insurance claims from homeowners, with the average cost per claim around $15,000 — more than double that in California.

A lightning strike can cause a home fire and other physical damage, but it can also cause an electrical surge, which can damage your appliances and electronics. Damage caused by lightning strikes is so costly because they often, and unfortunately, lead to house fires that require complete rebuilds.

Summer thunderstorms with lightning strikes lightning can fry unprotected appliances that are expensive and time-consuming to replace. Your standard North American electronic devices are rated for 120 volts.

A major lightning strike creates an electromagnetic pulse that can send millions of volts into a building or home’s electrical panel, wiring system, and connected devices, frying them instantly. Although it’s not possible to prevent your home from being struck by lightning, there are certain things you can do to protect your home and belongings from more extensive damage.

How to Protect Appliances from Lightning

When it comes to lightning strikes, your run-of-the-mill power strip doesn’t offer sufficient protection for appliances (although power strips are excellent supplemental protection). Installing a whole house surge arrester can cost a few hundred dollars but save you thousands in the long run.

A whole house surge arrester protects your home’s circuits directly at the electrical panel. A surge arrester will help protect your electronics from internal and external power surges, like lightning.

What Does Homeowners Insurance Cover?

In most cases, homeowner’s insurance policies cover damages caused by lightning strikes. However, it’s important to note that insurance policies can vary, so it’s crucial to review your policy’s specific terms and conditions to understand what is and isn’t covered.

Typically, homeowner’s insurance policies provide coverage for lightning-related damages under the section that pertains to “perils” or “covered perils.” Lightning is commonly included as a covered peril in these policies, along with other events such as fire, theft, and vandalism.

As a result, if your home sustains damage due to a lightning strike, your insurance policy may cover the necessary repairs or replacements. It may also cover some of your costs if your family must temporarily re-locate or stay in a hotel during repairs.

However, there may be certain limits on coverage, deductibles, or exclusions outlined in your policy. For instance, your insurance might cover repairs to your home’s structure, electrical systems, appliances, and personal belongings damaged by a lightning strike. However, specific items or circumstances may be excluded from coverage, such as damage to external structures like sheds or garages.

To obtain accurate information regarding your coverage, contact your insurance provider directly. They will be able to explain the specific details of your policy, any limitations or exclusions, and guide you through the claims process if necessary.

Lightning Claims Process

Insurance companies typically handle lightning damage claims similarly to other types of property damage claims. General steps include:

- Reporting the claim: The policyholder should report the lightning damage to their insurance company as soon as possible. This can typically be done through phone, email, or an online claims portal.

- Documentation: The policyholder should gather all relevant information and document the damage caused by the lightning strike. This may include taking photographs or videos of the damaged property and keeping records of any repairs or expenses related to the damage.

- Claims adjuster assessment: Once the claim is reported, the insurance company will assign a claims adjuster to assess the damage. The adjuster will evaluate the extent of the lightning damage, determine the value of the loss, and verify if the policy covers the specific damages caused by lightning.

- Policy review: The insurance company will review the policy to determine the coverage available for lightning damage. Most standard homeowner’s insurance policies typically cover lightning damage, but it’s essential to review the policy’s terms, conditions, and exclusions to understand the extent of coverage.

- Claim settlement: If the policy covers the lightning damage, the insurance company will proceed with the claim settlement. The settlement amount will depend on the policy’s coverage limits and deductibles, as well as the assessed value of the damage by the claims adjuster.

- Repairs and restoration: Once the claim is settled, the policyholder can proceed with the necessary repairs or restoration of the damaged property. The insurance company may provide a list of approved contractors or allow the policyholder to choose their own.

It’s worth noting that the specific procedures and details can vary between insurance companies and policies. It is always important for policyholders to thoroughly review their insurance policy, understand the coverage and exclusions, and contact their insurance company for specific guidance and instructions in the event of lightning damage.

After a Lightning Strike

Surge protectors have a limited lifespan, particularly in areas of the country with high surge activity. Protectors may need to be replaced periodically and definitely after a lightning strike. Look for a protector that has some way of letting you know if it has failed (usually referred to as “fault identification”), such as an indicator light or audible alarm, and is no longer protecting the connected equipment. When this happens, the protector should be replaced.

ICM Controls offers a complete catalog of Surge Protective Devices designed for single and multiple-phase protection and indoor and outdoor use.